In today’s fast-moving world, businesses deal with more data than ever before. From customer preferences to market trends, the sheer amount of information can be overwhelming. Traditional methods of processing this data often fall short, leading to missed opportunities. That’s where AI agents come in. These smart systems help businesses by analyzing data quickly and providing actionable insights, acting as partners to decision-makers.

The Problem Statement

The Challenge Businesses Face

Businesses today are swimming in data, whether it’s customer feedback, operational metrics, or market trends. But having too much data can be as problematic as having none if it’s not managed properly. Traditional methods of processing this data are often slow and prone to errors, leaving companies struggling to stay competitive in fast-changing markets.

How AI Agents Help

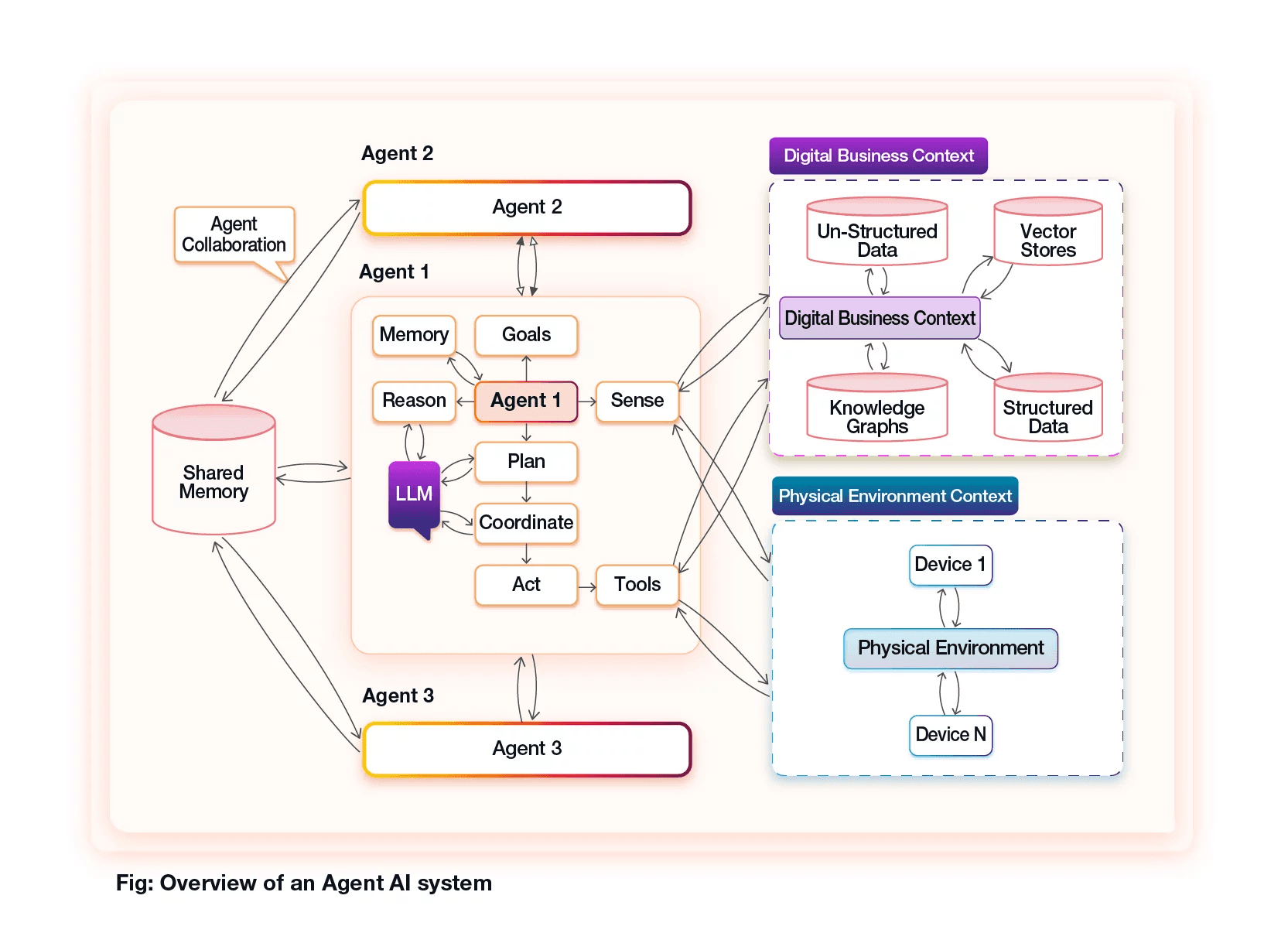

AI agents are game changers in this environment. They can analyze massive amounts of data in seconds, identifying patterns and offering actionable insights. This enables businesses to make smarter, faster decisions that would have been impossible with traditional approaches.

Source: HTC Global Service

The Core Role of AI Agents in Decision-Making

What AI Agents Do Best

AI agents excel at handling repetitive and data-heavy tasks that would otherwise drain human resources. For example, they can process vast datasets to find trends, predict customer behavior, or forecast risks. They’re also great at making real-time decisions, like adjusting pricing strategies or detecting anomalies, which helps businesses stay agile in a competitive landscape.

How AI Agents Work with Humans

Teamwork Between AI and People

AI and humans make a powerful team. While AI offers data-driven insights, humans bring creativity, intuition, and ethical judgment to the table. AI is also integrated into tools that businesses already use, like Slack or Microsoft Teams, making it easy for employees to collaborate with these systems. Additionally, AI can simulate different decision-making scenarios, helping leaders choose the best path forward.

The Benefits of AI Agents as Business Partners

Why Businesses Love AI

The advantages of AI are clear. First, AI eliminates bias by relying solely on data to make decisions, leading to more accurate outcomes. Second, by automating routine tasks, AI saves time and cuts costs, allowing businesses to focus on innovation. Finally, AI frees up human teams to tackle big-picture challenges, driving creativity and growth.

Challenges and Considerations

What to Watch Out For

Despite their benefits, AI agents come with challenges. Poor data quality can lead to bad results, so businesses need to ensure their data is clean and well-organized. Transparency is another issue, as some AI systems function like “black boxes” with unclear decision-making processes. Companies also need to address employee concerns about job displacement by offering training and support. Lastly, AI systems must comply with privacy laws to protect sensitive data.

Real-World Case Study: Finance - JP Morgan Chase

Making Contract Reviews Faster with COiN

JP Morgan Chase has revolutionized its legal processes with the help of its AI platform, COiN (Contract Intelligence). This tool scans and analyzes legal documents to extract key details like clauses, risks, and obligations. Traditionally, these tasks would take thousands of hours of manual effort. Now, COiN completes them in seconds, saving the company an estimated 360,000 hours annually. This not only speeds up operations but also reduces the likelihood of human errors, enabling the legal team to focus on more strategic tasks.

Stopping Fraud in Its Tracks

Fraud detection is another area where JP Morgan shines with AI. Its advanced AI systems monitor millions of transactions in real time, flagging anything that looks suspicious. These systems don’t just rely on predefined rules—they learn from new patterns over time, becoming smarter and more effective. This proactive approach not only prevents financial losses but also ensures that customers feel safe and secure while banking.

Personalizing Customer Experiences

AI also helps JP Morgan provide a personalized experience for its customers. By analyzing spending patterns, preferences, and behaviors, the bank’s AI tools recommend tailored financial products and services. For instance, AI-powered chatbots assist customers by answering questions, providing account updates, and suggesting solutions based on individual needs. This level of personalization keeps customers satisfied and loyal.

Managing Risks Proactively

Risk management is critical in finance, and JP Morgan uses AI to stay ahead. Predictive models analyze market data to foresee potential risks like economic downturns or market volatility. AI also ensures compliance by tracking regulatory requirements and flagging possible violations. This proactive approach helps the bank make informed decisions and maintain its reputation.

Smarter Investments

JP Morgan leverages AI to optimize investment portfolios for its clients. AI systems analyze market trends, assess asset performance, and align portfolios with client goals. These tools also provide real-time recommendations, allowing wealth managers to adjust strategies instantly. As a result, clients see better returns and reduced risks, which enhances their trust in the bank’s expertise.

Making Operations Smoother

AI plays a big role in streamlining JP Morgan’s internal operations. Tasks like data entry, reconciliation, and compliance checks are automated, reducing manual workload and errors. This automation not only improves efficiency but also cuts costs, allowing the bank to allocate resources to more strategic areas.

Creating Innovative Financial Products

AI enables JP Morgan to develop cutting-edge financial solutions. For example, smart lending tools assess creditworthiness using alternative data, making loans accessible to a broader range of customers. Dynamic pricing models adjust loan rates based on market conditions and individual profiles, offering more competitive and personalized options. These innovations help JP Morgan stand out in the market.

Empowering Employees

Lastly, JP Morgan uses AI to empower its employees. AI tools provide actionable insights, helping staff make better decisions. They also offer training modules and role-specific resources, ensuring employees are well-equipped to handle their tasks. This combination of support and empowerment boosts productivity and morale, ultimately benefiting the bank and its customers.

Conclusion

AI is changing the game for businesses, and JP Morgan Chase shows just how powerful it can be. From stopping fraud to creating personalized experiences, AI makes operations smoother, decisions smarter, and customers happier. For businesses looking to stay ahead, combining AI’s speed and precision with human creativity is the way forward. The future of business is here—and it’s powered by AI.

References

https://hbr.org/2024/12/what-is-agentic-ai-and-how-will-it-change-work

https://www.automationanywhere.com/rpa/agentic-ai#:~:text=A%20defining%20feature%20of%20agentic,all%20without%20constant%20human%20intervention.

https://www.htcinc.com/resources/agentic-ai-the-future-of-autonomous-decision-making/

https://konghq.com/blog/learning-center/agentic-ai

https://www.ibm.com/think/insights/agentic-ai

https://technologymagazine.com/articles/gartner-how-agentic-ai-is-shaping-business-decision-making

https://doi.org/10.48550/arXiv.2501.07913

https://doi.org/10.1016/j.copsyc.2019.07.039

https://doi.org/10.48550/arXiv.2410.01927

https://www.linkedin.com/pulse/case-study-jpmorgan-chases-contract-intelligence-coin-jorge-chirinos-qcyje/